The Autumn Budget introduced several measures aimed at balancing public finances while continuing to encourage long‑term saving. One of the headline announcements was a change to how National Insurance (NI) relief applies to pension salary sacrifice (also known as salary exchange). This adjustment, due to take effect from April 2029, reflects the government’s focus on ensuring fairness in tax advantages while still supporting pension contributions as one of the most generous savings incentives available.

Salary sacrifice has long been a popular arrangement for both employers and employees, offering immediate NI and tax savings while boosting retirement provision. However, with the new cap on NI relief, both businesses and workers will need to understand how the changes affect them and plan accordingly.

Key Changes

From April 2029, National Insurance relief on pension salary exchange will be capped at £2,000 per year.

- Your employees will still receive full tax relief on all contributions (subject to annual limits).

- NI savings will only apply up to the £2,000 cap (both for the employer and employee).

How Salary Exchange Works Today

As noted above, salary exchange allows your employees to exchange part of their salary for an equivalent employer pension contribution.

- Employee benefit: No income tax or NI on the sacrificed amount, giving immediate tax relief at the employee’s highest marginal rate.

- Employer benefit: Lower taxable salary reduces employer NI costs.

What’s Changing from April 2029

- NI relief will apply only to the first £2,000 of sacrificed contributions.

- Any amount above £2,000 will attract NI at your normal rate.

- Full tax relief remains unchanged (subject to allowances).

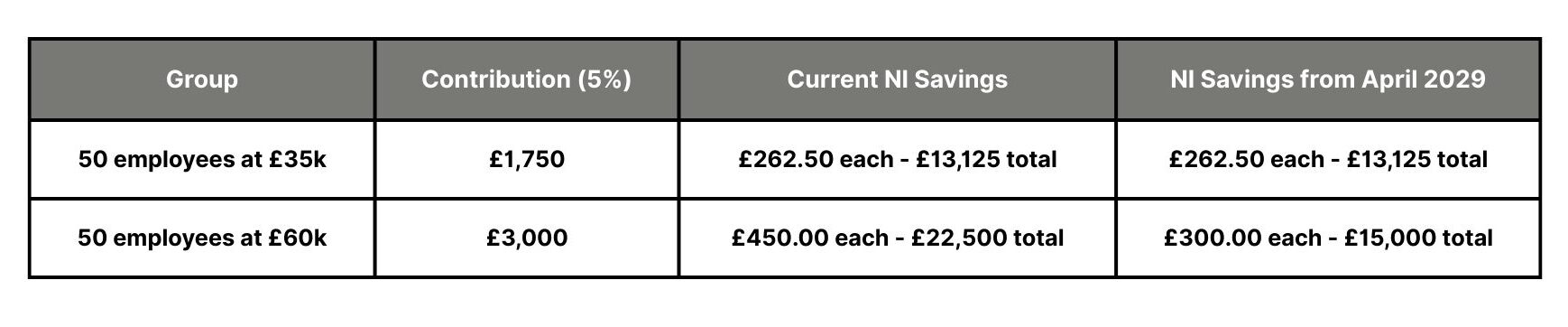

Employee Examples from 2029:

- Emma earns £35,000 and contributes 5% (£1,750).

→ NI relief applies to the full amount. - James earns £60,000 and contributes 5% (£3,000).

→ NI relief applies to £2,000; the remaining £1,000 is subject to NI.

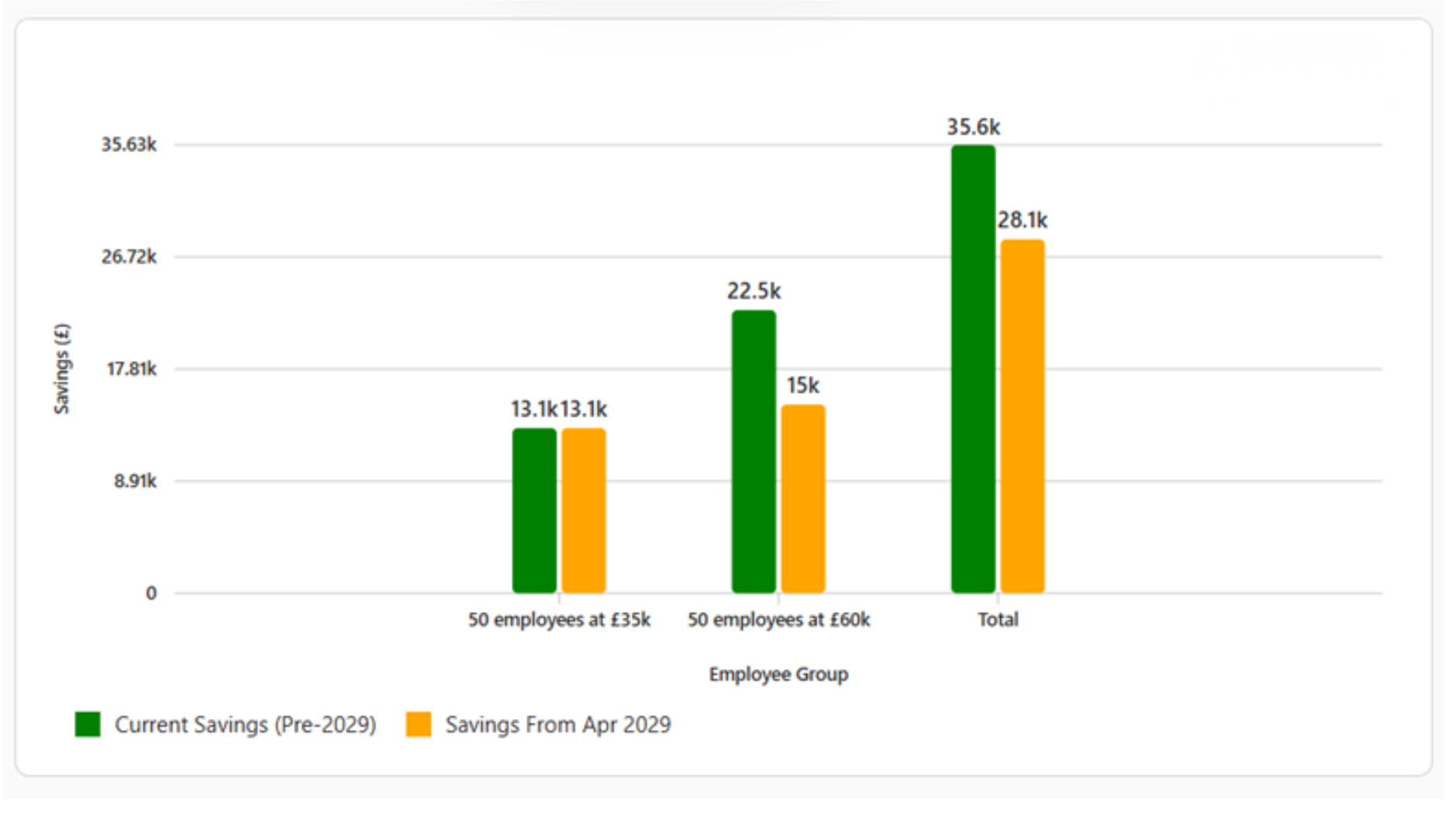

Employer National Insurance Savings Example Now V’s 2029

(100 employees, employee pays 5% contributions, Employer NI rate = 15%)

Employer NI Savings summary pre and post changes:

- Now (pre-2029): £35,625 saved annually

- From April 2029: £28,125 saved annually

- Employer saving reduced by £7,500 per year

Is Salary Sacrifice still valuable after the National Insurance Cap?

For Employees

- Employees still save NI on the first £2,000 that the employee contributes

- Full tax relief remains: Contributions still reduce taxable income, helping avoid higher tax bands which keeps pensions as one of the most generous tax breaks available

- Avoids extra admin for higher-rate earners: Salary exchange means higher-rate taxpayers automatically receive full tax relief without having to claim additional relief via self-assessment.

For Employers

- Continued NI savings: Employers still save NI on the first £2,000 per employee.

- Enhanced employee benefits: Offering salary exchange remains an attractive option for recruitment and retention.

- Option to reinvest savings to enhance wider Employee Benefit offering

Try Our Salary Exchange Calculator

We’ve enhanced our Salary Exchange Calculator to reflect the Autumn Budget changes. Employers can now toggle between today’s rules and the new £2,000 NI relief cap coming in April 2029. This allows you to instantly compare current savings with future figures, helping you plan ahead and understand the impact on both employer and employee contributions. Try it here.

While the Autumn Budget changes will cap National Insurance savings from April 2029, pension salary sacrifice remains one of the most effective ways to boost pension contributions and reduce taxable income. Employees will continue to benefit from full tax relief and NI savings on the first £2,000, while employers retain meaningful NI savings and a valuable tool for recruitment and retention.

Please don’t hesitate to contact one of our Employee Benefits team, should you have any questions or would like to find out more.

📞 02920 853788 | ✉ eb@thomas-carroll.co.uk